ITR-4- Key Insertions in the Income Tax Return form Now Available for E-Filing at Income Tax Portal for Assessment Year (AY) 2020-21 / Financial Year (FY) 2019-20

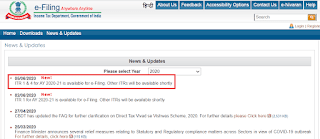

Today i.e. on the 5th of June, 2020, the department has made the Income Tax Return Preparation Software (also known as the income tax return utility) for ITR-4 available on its e-Filing portal for filing the income tax returns.

Starting today, all the taxpayers will be able to file their ITR-4 pertaining to financial year 2019-20.

ITR-4- For individuals, HUFs and Firms (other than LLP) being a resident having total income up to Rs.50 lakh and having income from business and profession which is computed under section 44AD, 44ADA or 44AE and not for an individual who is either Director in a company or has invested in unlisted equity shares.

Detail change of ITR-4: Click here

No comments:

Post a Comment

Thank you for your comment to Ace Business Academy. We will get back to you soon.