The concept ‘GST Practitioner’ being introduced by the

Indian Government under the GST Act, 2017.

Eligibility Criteria for becoming a GST Practitioner:

A person is eligible for becoming a GST practitioner under

the GST regime if he or she satisfies the below mentioned conditions, He / She:

·

is a citizen of India

·

is mentally solvent (of sound mind)

·

is not declared as an insolvent

·

is not been convicted of an offence with imprisonment for a

period exceeding two years.

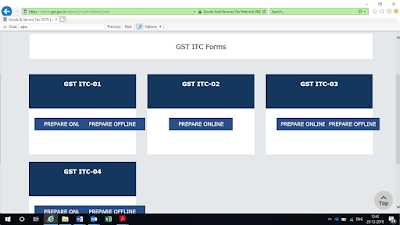

Qualification required for becoming a GST Practitioner:

So far, GST does not create any bar for the candidates who

want to work as a GST Practitioner. A qualified professional or a non-qualified

professional like a graduate can bag the role of a GST Practitioner by duly

upgrading their knowledge.

Real fact and data:

Total number of registered business in India (before GST) was around 60 lakhs and it raised( after GST) 1.21 crore (on 2019). So the registration almost double within two years and the number is still increasing. So huge demand for GST practice, jobs & consulting creates these days. You need to be proper knowledge, guideline, practical experience, technical skills and patience to become a GST Practitioner.

The openings for GST practitioners in India are currently at an extreme high. However, the professionals who are initiating to do the work in GST field are insufficient in the market.

We are here for helping you:

If you are an aspirant who is looking forward to build your career in the lucrative GST field, we are here for helping you through your entire journey of becoming a GST practitioner.

Check

out our Mentorship Program and Syllabus

Check our Instagram and Facebook pages regularly if

you wish to stay updated.

WhatsApp-

9073323071 or 9073323073

Check your basic

knowledge in this field: Click here