The GSTN has enabled the Form GST ITC-02A, wherein a registered person gives a declaration of unutilized ITC transferred for obtaining a separate registration within the same state or union territory.

(1) A registered person who has obtained separate registration for multiple places of business in accordance with the provisions of Rule 11 and who intends to transfer, either wholly or partly, the unutilized input tax credit lying in his electronic credit ledger to any or all of the newly registered places of business, shall furnish within 30 days from obtaining such separate registration, the details in Form GST ITC-02A electronically on the common portal either directly or through facilitation, center notified on this behalf by the commissioner.

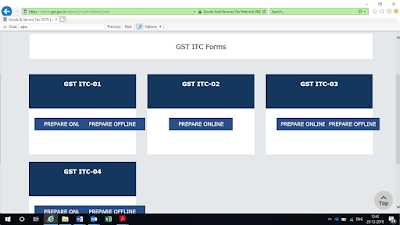

Details to be furnished in Form GST ITC-02A are as follows:

Source #GSTN Portal

No comments:

Post a Comment

Thank you for your comment to Ace Business Academy. We will get back to you soon.